8 of the best converted industrial properties for sale

The best converted industrial properties for sale – from a Victorian railway station in Norfolk to a Grade II-listed former water tower with views of the River Alde

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Water Tower, Aldeburgh, Suffolk.

A Grade II-listed, 1870s former water tower with a rooftop pavilion and far-reaching views of the River Alde. It has a double-height drawing room that retains its original arched windows and steel beams, and a bespoke breakfast kitchen with an Aga. 6 bedrooms, 5 bathrooms, 2 receptions, studio.

Price: £2.75m Savills 01473-234 800.

Lewis Cubitt Square, King’s Cross, London N1C.

A flat in a converted, Grade II-listed cast-iron gas-holder frame in the Gasholders development in King’s Cross. It is situated beside a landscaped park and has a private balcony and shared access to a business lounge, rooftop garden and 24-hour concierge.

Price: £1.08m Dexters 020-7833 4466.

East Norfolk House, Thorpe Market, Norfolk.

A converted Victorian railway station dating from 1876. It retains its exposed timbers and the original vaulted ceilings, and maintains as much of the original station layout as possible, which includes the original platform. It has a living room with an open fireplace. 3 bedrooms, 3 bathrooms, 2 receptions, dining kitchen, pantry, store, shed, gardens, 1.1 acres.

Price: £850,000 Sowerbys 01263-710777.

East Norfolk House, Thorpe Market, Norfolk.

A converted Victorian railway station dating from 1876. It retains its exposed timbers and the original vaulted ceilings, and maintains as much of the original station layout as possible, which includes the original platform. It has a living room with an open fireplace. 3 beds, 3 baths, 2 receps, dining kitchen, pantry, store, shed, gardens, 1.1 acres.

Price: £850,000 Sowerbys 01263-710777.

East Norfolk House, Thorpe Market, Norfolk.

A converted Victorian railway station dating from 1876. It retains its exposed timbers and the original vaulted ceilings, and maintains as much of the original station layout as possible, which includes the original platform. It has a living room with an open fireplace. 3 beds, 3 baths, 2 receps, dining kitchen, pantry, store, shed, gardens, 1.1 acres.

Price: £850,000 Sowerbys 01263-710777.

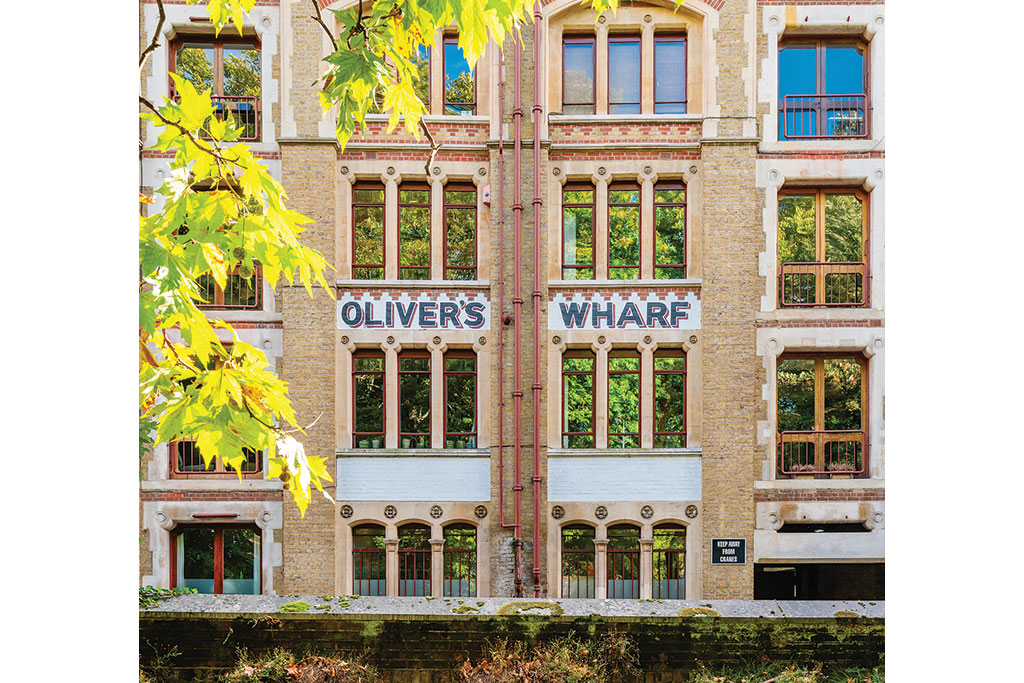

Oliver’s Wharf, London E1W.

A flat in a Grade II-listed converted Victorian warehouse beside the River Thames, originally designed by Gothic Revival architects Frederick and Horace Francis. It has a large open-plan dining/living area and a balcony overlooking the river. Bedroom, 2 bathrooms, reception, kitchen, sound-proofed music studio/bedroom 2, secure parking, lift access, building manager.

Price: £3m Knight Frank 0203-823 9944.

Pump House, Wycoller Road, Wycoller, Colne, Lancashire.

A conversion of a steam-powered water-pumping station built over 100 years ago, situated in a quiet location. It retains its exposed stone walls, vaulted ceilings and arched doors, and has a spiral staircase and a dining room with a minstrels’ gallery. 3 bedrooms, bathroom, 2 receptions, breakfast kitchen, double garage, formal gardens.

Price: £625,000 Fine & Country 01200-420747.

The Court House & The Old Police Station, Corwen, Denbighshire.

A Grade II-listed house that was once a police station and courthouse, situated in a small town in an Area of Outstanding Natural Beauty. It has beamed ceilings and a courtyard garden. 4 bedrooms, 3 bathrooms, 2 receptions, 2-bedroom flat.

Price: £625,000 Harding Green 020-3879 0742.

The Gasworks, Upper Slaughter, Cheltenham, Gloucestershire.

A converted 1870s acetylene gasworks, which once served a nearby estate. The original stone facade has been restored and is now complemented by a Corten steel extension, a watch tower housing a home office, and a glass hallway that connects the old buildings with the new ones. 5 bedrooms, 4 bathrooms, 2 receptions, kitchen, outbuilding, inner courtyard, gardens.

Price: £1.85m Savills 01451-832832.

The Reservoir, Harrietsham, Kent.

A converted 1930s reservoir with panoramic views towards the North Downs. It has a concrete exterior and large internal spaces that have polished concrete and wood floors, concrete ceilings and columns, and floor-to-ceiling sliding doors and windows. 5 bedrooms, 4 bathrooms, open-plan kitchen/living room, summer kitchen, studio, home office, swimming pool, roof terraces and balconies, gardens, 6 acres.

Price: £2.7m The Modern House 020-3795 5920.

The Reservoir, Harrietsham, Kent.

A converted 1930s reservoir with panoramic views towards the North Downs. It has a concrete exterior and large internal spaces that have polished concrete and wood floors, concrete ceilings and columns, and floor-to-ceiling sliding doors and windows. 5 beds, 4 baths, open-plan kitchen/living room, summer kitchen, studio, home office, swimming pool, roof terraces and balconies, gardens, 6 acres.

Price: £2.7m The Modern House 020-3795 5920.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Natasha read politics at Sussex University. She then spent a decade in social care, before completing a postgraduate course in Health Promotion at Brighton University. She went on to be a freelance health researcher and sexual health trainer for both the local council and Terrence Higgins Trust.

In 2000 Natasha began working as a freelance journalist for both the Daily Express and the Daily Mail; then as a freelance writer for MoneyWeek magazine when it was first set up, writing the property pages and the “Spending It” section. She eventually rose to become the magazine’s picture editor, although she continues to write the property pages and the occasional travel article.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

Should you sell your Affirm stock?

Should you sell your Affirm stock?Affirm, a buy-now-pay-later lender, is vulnerable to a downturn. Investors are losing their enthusiasm, says Matthew Partridge

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Beeks – building the infrastructure behind global markets

Beeks – building the infrastructure behind global marketsBeeks Financial Cloud has carved out a lucrative global niche in financial plumbing with smart strategies, says Jamie Ward

-

Saba Capital: the hedge fund doing wonders for shareholder democracy

Saba Capital: the hedge fund doing wonders for shareholder democracyActivist hedge fund Saba Capital isn’t popular, but it has ignited a new age of shareholder engagement, says Rupert Hargreaves